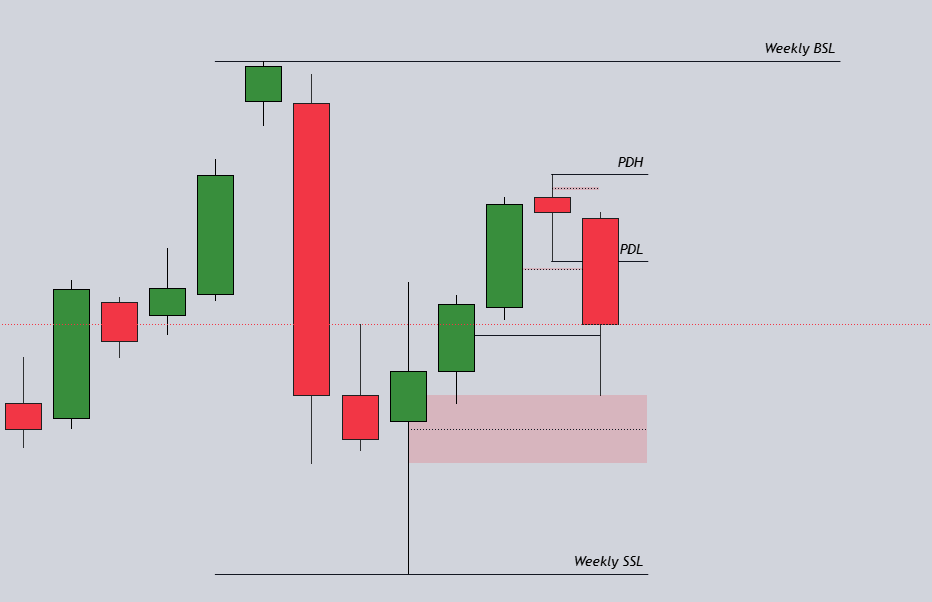

Overall, my daily bias on the 27th of December was quite bearish with an expected formation of a bearish PO3 during the NYAM open. This caused me to enter into shorts for the day.

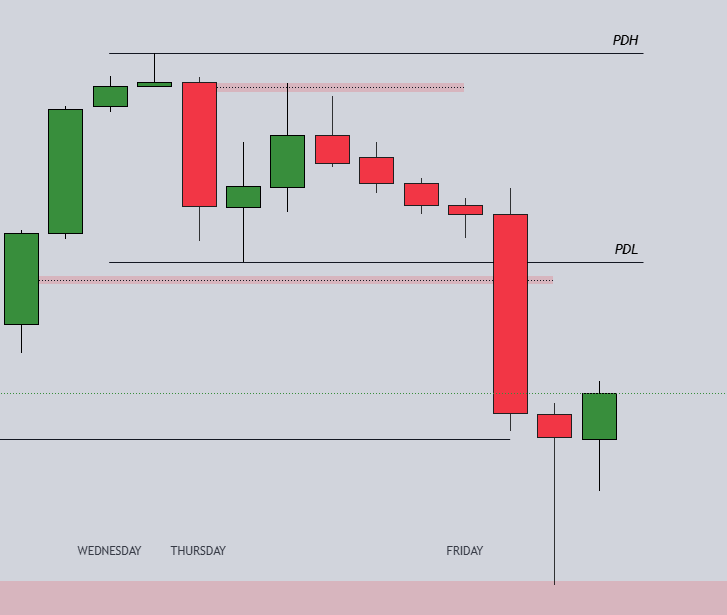

Daily Time Frame

On the 26th, the market experienced a consolidation phase, with prices remaining relatively stable. However, on the 27th, there was a dramatic shift as prices plummeted, breaking through the previous day’s lows and resulting in a significant downward movement.

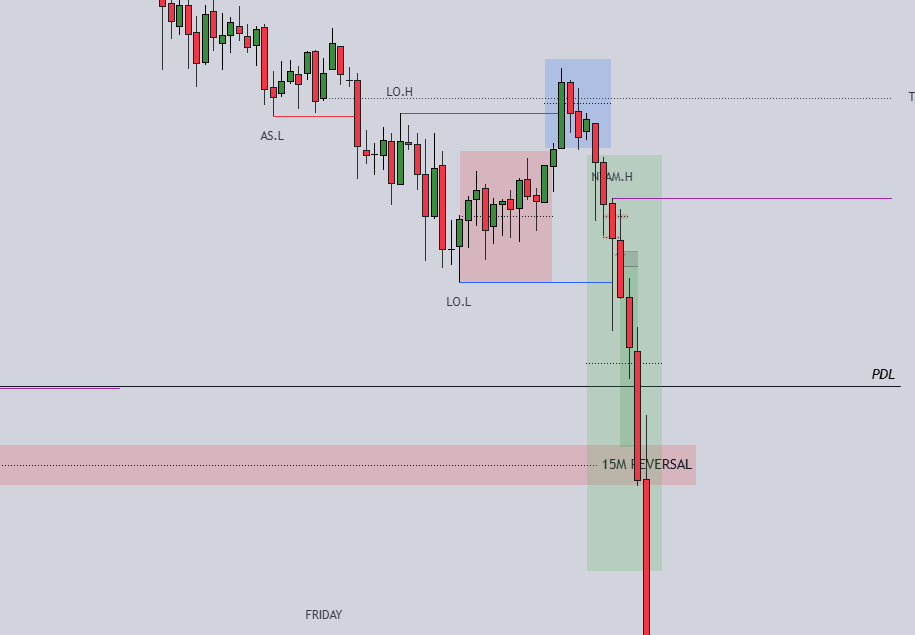

4 Hour Time Frame

When we zoom in on the four-hour time frame, it becomes evident that the price decisively broke below the previous day’s lows with a powerful bearish candle.

It also tried to take out another low, but couldn’t manage to close beneath it.

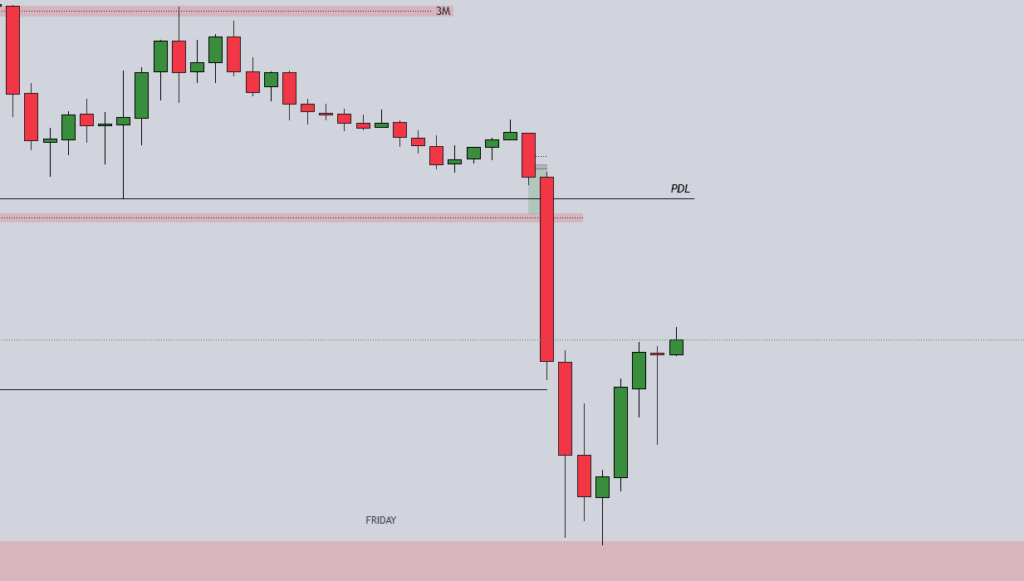

Hourly Time Frame

Zooming out to the hourly time frame, we observe that the price is currently retracing into an hourly fair value gap after experiencing a significant drop. This movement respects the fair value gap, which lies within the Optimal Trade Entry (OTE) level of the range, suggesting a potential area of interest for traders.

30 Minute Time Frame

On the thirty-minute time frame, we can see that the price is rebalancing after a significant drop, aligning with the bearish trend. This movement not only reinforces the earlier sell-off but also results in the price taking out both the Asian and London session lows, signaling continued selling pressure.

15 Minute Time Frame

During the London session and the onset of the NYAM session, a clear AMD setup emerged that strongly validated my trading bias. This confirmation provided a solid foundation for my expectations moving forward.

3 Minute Time Frame

The three-minute time frame played a crucial role in shaping my daily bias. As the price rebalanced into a three-minute fair value gap, it presented a critical point of analysis. Had the price invalidated this gap, my outlook would have shifted to bullish. However, since it respected the gap and continued to decline, I maintained a bearish bias for the day.

1 Minute Time Frame

In the 1-minute time frame, I waited for an entry into my trade as the NYAM session started. Price started slowly dumping at the start of the session, before retracing into a 1-minute fair value gap that was around the optimal trade entry of the current range. However, I didn’t want to enter there yet, as price still possibly had a tendency to take the latest swing high, and I wanted to see an confirmation after the strong bearish candle before taking my trade.

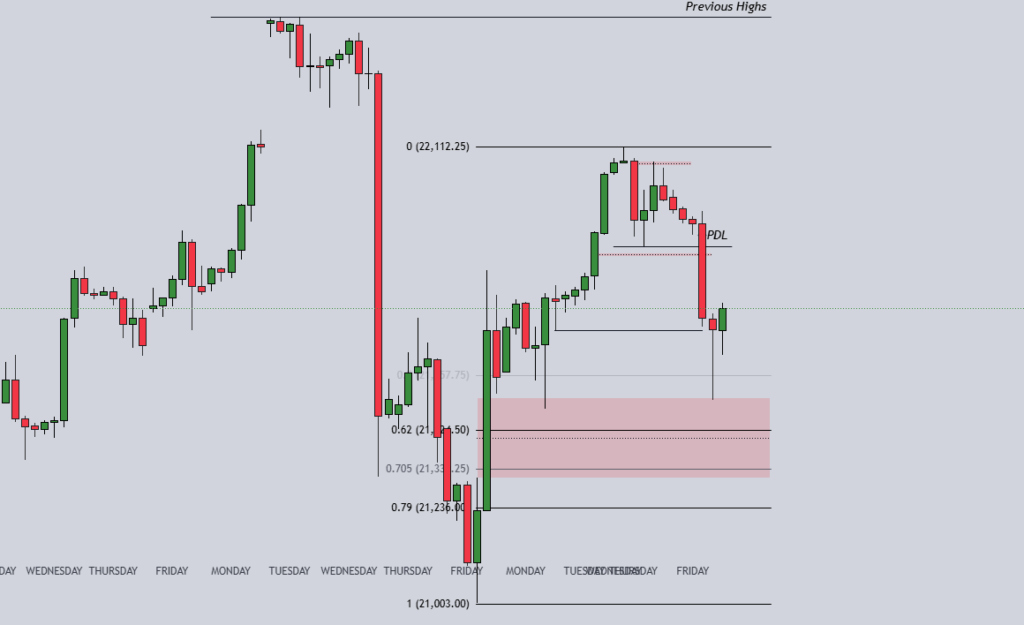

Post Trade/Post NYAM Open

After the price was fully dumped, the rest of the day was almost fully consolidated. Additionally, price was reacting off an hourly fair value gap that formed, possibly pushing up higher from there.

First Week of January Predictions

For next week, and the overall price action in January, I am predicting for price to reach a bit lower in the marked-out fair value gap, roughly into the OTE of the current range, before pushing up for higher prices, taking out previous highs.

Conclusion

Overall, this was the best price action I’ve seen all week. There was an almost perfect 9:30 PO3 that formed, with price retracing back into an OTE level with a fair value gap before dumping for the trade. With December being a horrendous month for price action, I hope that for January, price action starts returning to normal.

Find out more?

Watch our video on the daily recap and trade recap of the 27th of December for more information!