The power of three and accumulation, manipulation, and distribution (AMD) are fundamental concepts in trading that help traders understand market dynamics across various time frames. Each phase represents a different stage in the market cycle and offers insights into potential price movements and trading strategies.

What is AMD?

As stated above, AMD is a three-phase market setup that happens at every time frame every day. This is split into three separate sections. Accumulation, manipulation, and distribution. This was a trading cycle created by Wyckoff before being used in the institutional trading system today.

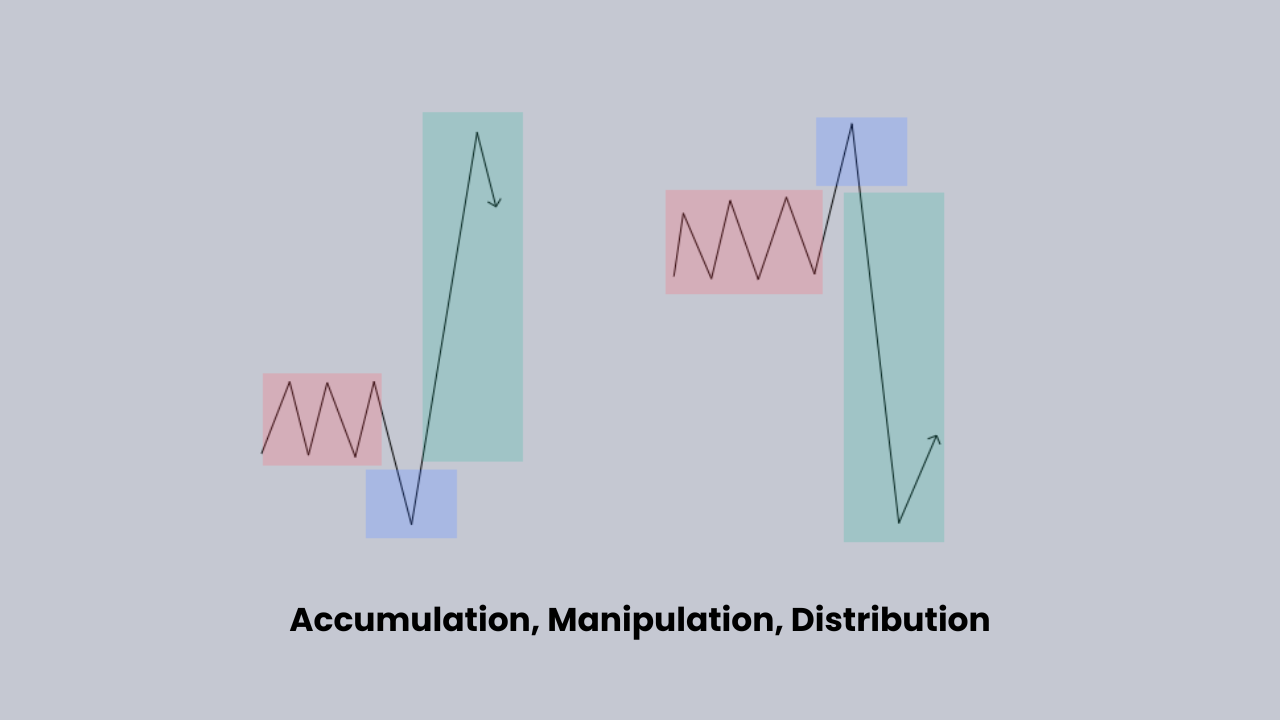

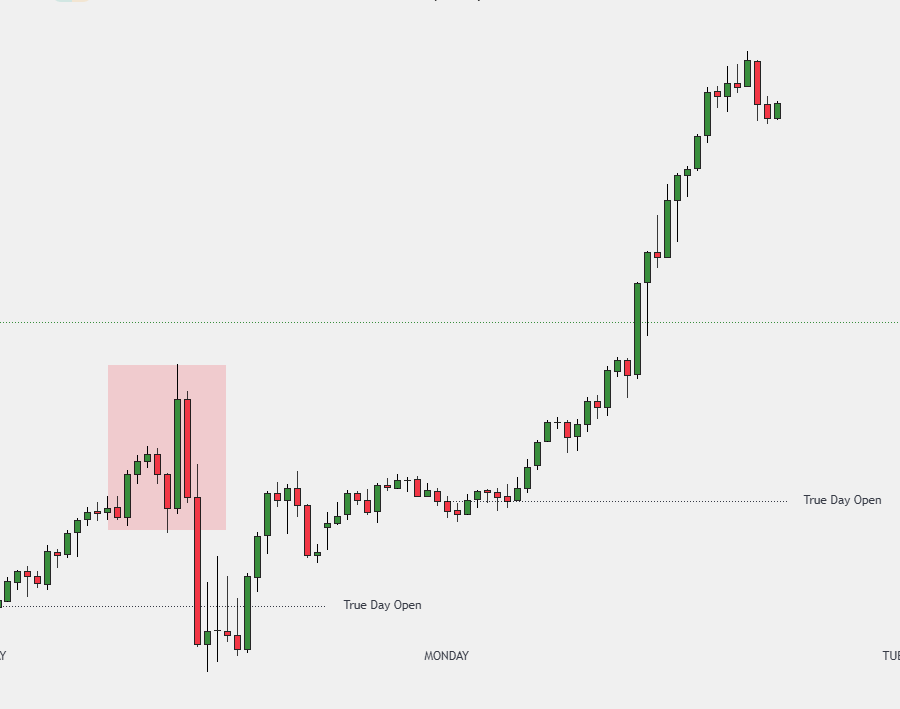

The market begins in the accumulation stage, characterized by a period of consolidation where prices stabilize within a specific range. This phase typically occurs at the start of the trading day, during which there is no clear trend direction. Traders observe that prices are gathering momentum within this defined range, indicating that market participants are accumulating positions. This accumulation phase is highlighted in red in the image below.

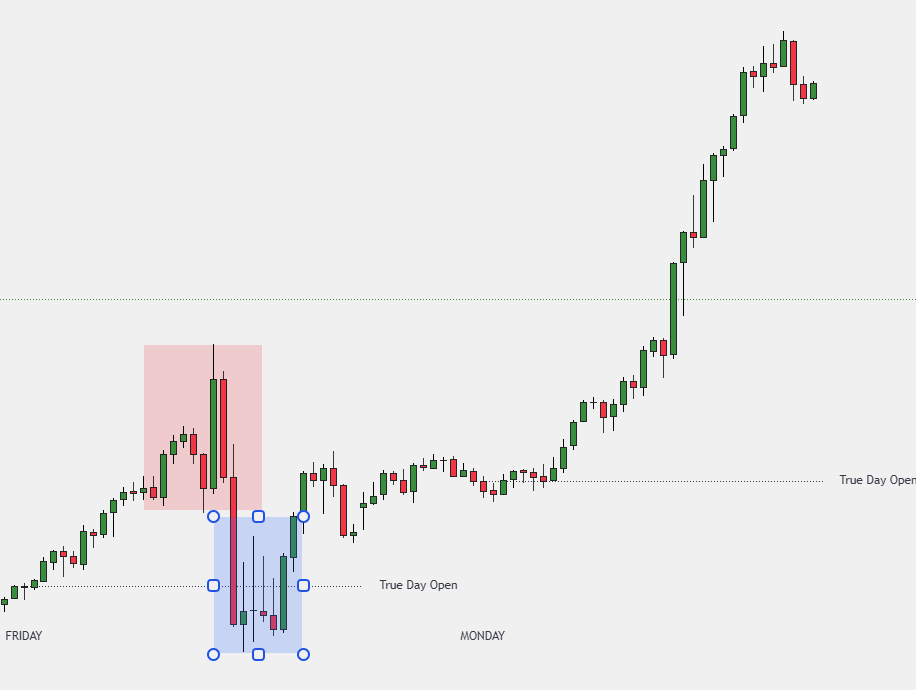

The market enters a manipulation phase, characterized by deceptive price movements designed to trap traders and trigger stop-loss orders. During this phase, prices may experience a false swing, moving sharply in the opposite direction. This manipulation seeks to catch retail traders off guard, leading to losses as their stop-loss orders are activated. This is illustrated in the blue box below.

The final phase of this setup is distribution, where the market responds to the earlier manipulation by expanding in the intended direction. During this phase, prices begin to move significantly, reflecting the objectives of larger market participants who are now selling off their accumulated positions. This price action typically leads to a downward movement, as the market reaches the levels that traders aimed for during the manipulation phase. This transition is highlighted in the green box below.

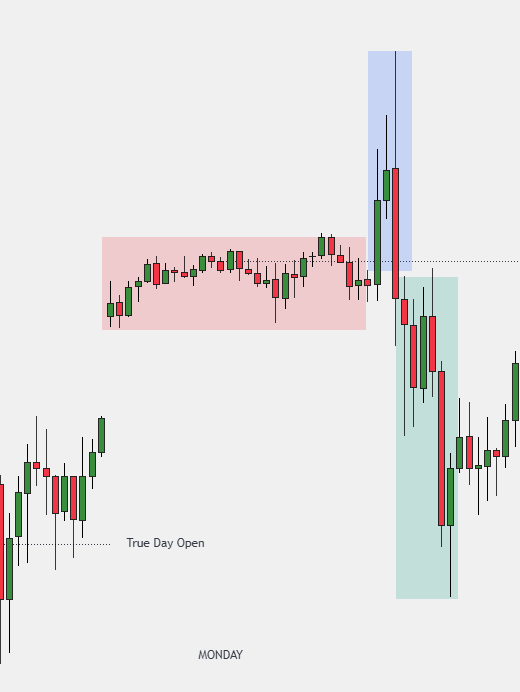

This process can occur in both bearish and bullish formations. An example of a bearish setup is illustrated below. In this scenario, the market exhibits characteristics typical of a downtrend, where the distribution phase leads to a significant price decline following the manipulation.

What is Power of 3?

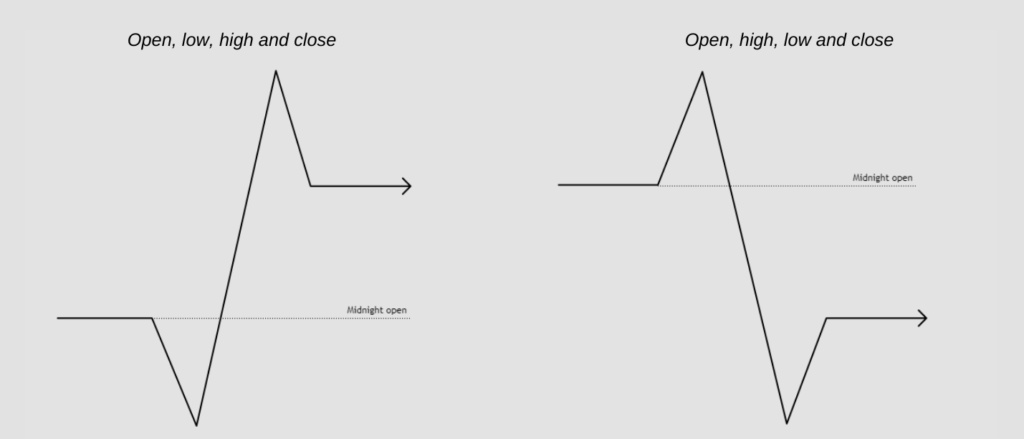

The Power of Three and AMD share similar underlying principles, but the Power of Three offers a distinct framework for understanding market dynamics. This concept can be further categorized into two key patterns: Open Low High Close (OLHC) and Open High Low Close (OHLC). These patterns help traders analyze price action and market behavior more effectively, providing valuable insights into potential trading opportunities.

By identifying these phases in real time, traders can optimize their entry and exit points, reducing the risk of being caught on the wrong side of the market. This strategy highlights how institutional players manipulate price movements to exploit the emotions and stop-losses of retail traders.

However, AMD and Power of Three should not be used in isolation. This three-phase trading setup is most effective when combined with other confluences and price distribution arrays. By integrating these elements, traders can enhance their analysis and increase the likelihood of achieving an A+ setup. Make sure to note that this setup is fractal, meaning that it can be in use in every time frame. Enjoy trading!

Find out more?

In order to get into more depth about what AMD and PO3 are, watch our YouTube video down below, where our team helps explain what this setup in the markets mean!