In the world of trading, managing risk is paramount to long-term success. One of the most effective tools at your disposal is stop-loss. Think of it as your safety net, designed to help you minimize potential losses and protect your capital. Just like a “get out of jail free” card in a game, a stop-loss can prevent your investments from spiraling into significant losses.

In this blog article, we’ll explore the various aspects of stop-loss orders, including their importance, how to set them effectively, and common pitfalls to avoid. Whether you’re a seasoned trader or just starting, understanding stop-loss strategies can enhance your trading performance and safeguard your investments. Let’s dive in and discover how this simple yet powerful tool can make a significant difference in your trading journey.

What is a Stop-Loss Order?

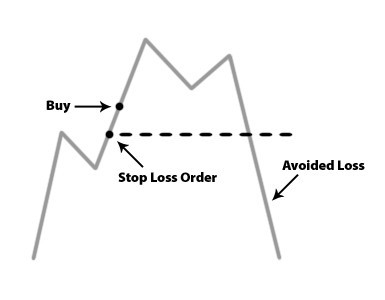

A stop-loss order automatically sells a security when it reaches a predetermined price, allowing you to exit a position before losses accumulate. This strategy not only helps you maintain control over your trades but also instills a disciplined approach to trading. By setting a stop-loss, you can enter the market with a clear plan, reducing the emotional stress that often accompanies trading decisions.

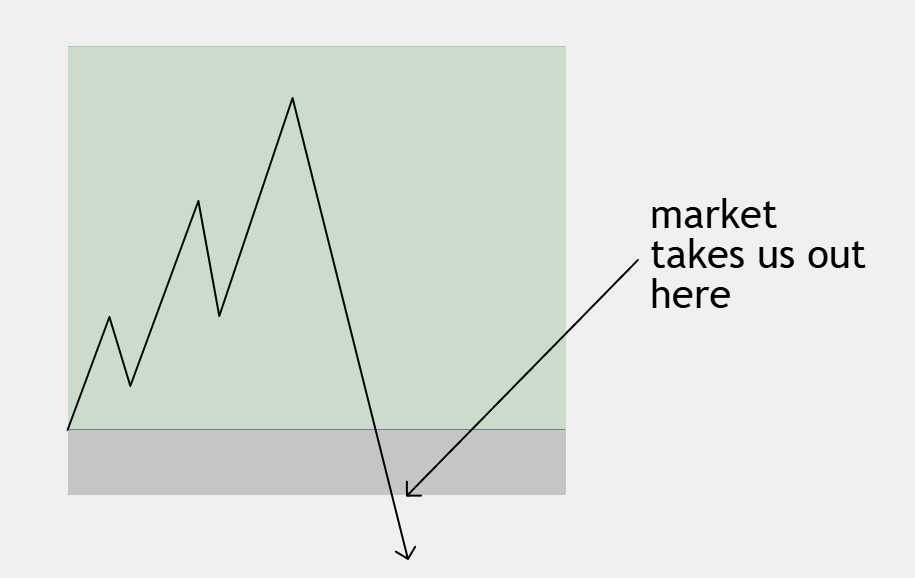

For example, a trader buys a stock and sets a stop-loss limit with a risk of 1% of their account. Once the stop-loss gets hit, the market automatically takes them out of the trade to prevent them from losing any more money, almost like a protection order.

The Importance of Stop-Loss Orders

1. Risk Management

At its core, trading involves risk. A stop-loss serves as a crucial component of risk management, helping you define how much you’re willing to lose on a trade. By setting this limit, you can make informed decisions rather than relying on emotions during market fluctuations.

2. Emotional Discipline

One of the biggest challenges traders face is the emotional turmoil that can arise from losses. A stop-loss takes the decision-making process out of your hands during stressful moments, allowing you to stick to your trading plan without second-guessing yourself.

3. Capital Preservation

Protecting your capital is essential for long-term success. By using stop-loss orders, you can prevent small losses from accumulating into larger ones, thereby preserving your trading capital for future opportunities.

How To Set Your Stop-Loss?

1. Determine Your Risk Tolerance

Before entering a trade, assess how much risk you can afford to take. This involves evaluating your overall portfolio and deciding what percentage of your capital you’re willing to risk on a single trade. A typical rule of thumb for traders is a risk anywhere between 0.5-1% of your account for anything below an A+ setup, and risk heavier, from 1%-1.5% of your account for an A+ setup. For example, if you have a 50k account, 1% means that your maximum loss would be 500$.

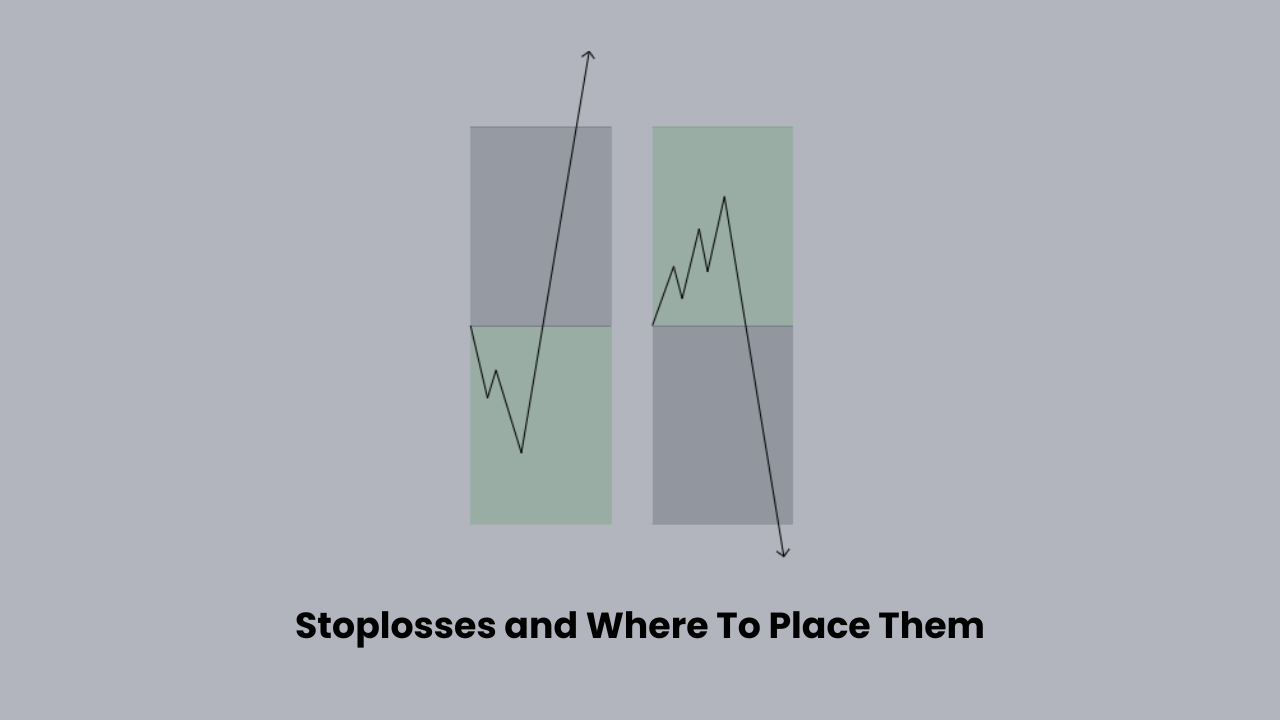

2. Latest Swing Point

Usually, you would set your stop-loss at the latest swing point, where this would be a swing low if you are longing, and a swing high if you are shorting. These are usually protected highs in the market where it is safe to set your stop-loss.

3. Trailing Stop Loss

A trailing stop-loss moves with the market price, allowing you to lock in profits as the price rises while still providing a safety net if the market reverses. This can be particularly useful in trending markets. Trailing stop-loss means that you are moving your stop-loss higher than before, usually to break even, and then 25% of the amount you’ve made. Where you trail your stop-loss completely depends on your own rules and the confluences/analysis you see in the market.

What to Avoid

1. Setting Stop-Losses Too Tight

While it’s essential to protect your capital, setting your stop-loss too close to your entry point can lead to premature exits. Price fluctuations can trigger your stop-loss, leading to losses even in a profitable trade.

2. Ignoring Market Conditions

Market conditions can change rapidly. Always consider external factors, such as earnings reports or economic indicators, that might affect price movements when setting your stop-loss. Always check forexfactory.com before entering any trades.

3. Emotional Decision-Making

Avoid adjusting your stop-loss based on emotions. Once you’ve set your stop-loss, stick to it. Constantly moving it to avoid losses can lead to worse outcomes and undermine your trading strategy. This will also hurt you in the long run, destroying your psychology and hurting your belief in your analysis.

Conclusion

Incorporating stop-loss orders into your trading strategy is not just a precaution; it’s a fundamental practice that can significantly enhance your trading discipline and overall performance. By effectively managing risk, preserving your capital, and maintaining emotional control, you can navigate the complexities of the trading landscape with confidence.

Remember, successful trading is not just about making profits—it’s also about managing losses. Embrace the power of the stop-loss, and watch as it transforms your approach to trading, helping you become a more disciplined and informed trader.

Find out more?

In order to get into more depth about what stop-losses are, watch our YouTube video down below, where our team helps explain how to set stop-losses in the market in the markets!